Yesterday’s Advisor offered healthcare results from the Society for Human Resource Management’s (SHRM) 2014 Benefits Survey; today, the survey’s results for other types of benefits.

|

The survey, sent to a random sample of SHRM members, had 510 respondents, which was a 13% response rate.

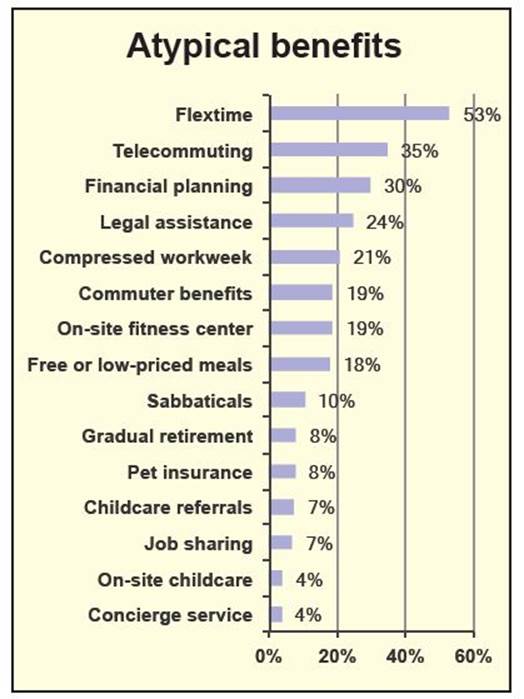

The table below indicates the prevalence of various other benefits.

|

Other Types of Benefits |

Percent |

Planning |

|

On-site parking |

90% |

0% |

|

Company-paid group life insuranceA |

83% |

0% |

|

Dependent care flexible spending account |

64% |

<1% |

|

Service anniversary awardB |

59% |

2% |

|

Undergraduate educational assistance |

54% |

2% |

|

Life insurance for dependents |

54% |

<1% |

|

Graduate educational assistance |

50% |

1% |

|

Incentive bonus plan (executive) |

45% |

1% |

|

Phone subsidy for business use of personal cell/smart phone |

42% |

<1% |

|

Business cell/smart phone for personal use |

41% |

0% |

|

Employee referral bonus |

41% |

1% |

|

Spot bonus/awardC |

41% |

2% |

|

Incentive bonus plan (nonexecutive) |

40% |

1% |

|

Shift premiums |

35% |

<1% |

|

Employee discount on company services |

33% |

0% |

|

Donations for participation in charitable events |

33% |

1% |

|

Sign-on bonus (executive) |

28% |

<1% |

|

Automobile subsidy for business use of personal vehicles |

26% |

<1% |

|

Credit union |

26% |

0% |

|

Full flexible benefits planD |

24% |

1% |

|

Accident insuranceE |

24% |

0% |

Managing an HR Department of One was recently recognized as one of SHRMStore’s “Great 8” best-selling products. Find out what all the buzz is about. (New California version available. Click here.)

|

Accelerated death benefitsF |

21% |

<1% |

|

Company-owned car for employee use |

20% |

0% |

|

Matching employee charitable contributions |

20% |

1% |

|

Sign-on bonus (nonexecutive) |

20% |

<1% |

|

Financial advice offered onlineG |

19% |

2% |

|

Employee technological device (e.g., computers, tablets) purchase discounts (not a loan) |

19% |

0% |

|

Payroll advances |

18% |

0% |

|

Financial advice offered one-on- oneG |

17% |

1% |

|

Financial advice offered in group/classroomG |

14% |

2% |

|

Safety bonus/incentive |

13% |

2% |

|

Credit counseling serviceH |

13% |

1% |

|

Educational scholarships for members of employees’ families |

13% |

<1% |

|

Retention bonus (executive) |

13% |

<1% |

|

Loans to employees for emergency/disaster assistance |

12% |

0% |

|

Retention bonus (nonexecutive) |

12% |

<1% |

|

Employee stock purchase plan |

12% |

<1% |

|

Qualified transportation spending account |

10% |

<1% |

|

Transit subsidy |

10% |

<1% |

|

Restricted stock options |

10% |

1% |

|

Incentive stock options (ISOs) |

9% |

<1% |

|

Parking subsidy |

7% |

0% |

|

Nonqualified stock optionsI |

7% |

<1% |

|

Automobile insurance program |

6% |

0% |

|

Low-/no-interest loans to employees for nonemergency situations |

6% |

<1% |

|

529 PlanJ |

6% |

<1% |

|

Free computers for employees’ personal use |

5% |

0% |

|

Loans for employees to purchase personal computers |

5% |

<1% |

|

Carpooling subsidy |

3% |

0% |

|

Free or discounted home Internet service |

3% |

0% |

|

Stock appreciation rights (SARs) |

3% |

<1% |

|

Subsidized cost of elder care |

2% |

<1% |

|

Educational loans for members of employees’ families |

2% |

0% |

|

Free commuter shuttle |

2% |

0% |

|

Personal tax services |

1% |

<1% |

|

Divorce insurance |

<1% |

<1% |

|

Grooming subsidy/reimbursementK |

<1% |

0% |

Feel as if you’re all alone in HR? Take on a partner—Managing an HR Department of One. Get more information. (New California version available. Click here.)

A Does not pertain to employee-paid supplemental insurance.

B Based on the number of years of employment.

C Unscheduled bonus/award for going above and beyond in some capacity.

D Ability to select from a variety of benefits.

E Separate from travel accident insurance.

F For terminal illnesses.

G Financial advice is defined as providing employees with information on how to manage their financial resources effectively for a lifetime of financial well-being.

H Credit, debt consolidation, housing counseling, etc.

I NQSOs or NSOs.

J Tax-advantaged savings plan designed to encourage saving for future college costs.

K For example, manicures, pedicures, haircuts.

Source: 2014 Employee Benefits: A Research Report by SHRM

Here, for more information on benefits are some results about other types of benefits from a recent BLR® survey:

You can access the entire SHRM 2014 Employee Benefits Survey at http://www.shrm.org/research/surveyfindings/articles/pages/2014-employee-benefits.aspx.

What policies to have, what to put in them … a continuing challenge for HR, and in a small department, it’s just that much tougher.

BLR’s Managing an HR Department of One is unique in addressing the special pressures small HR departments face. Here are some of its features:

- Explanation of how HR supports organizational goals. This section explains how to probe for what your top management really wants and how to build credibility in your ability to deliver it.

- Overview of compliance responsibilities through a really useful, 2-page chart of 23 separate laws that HR needs to comply with. These range from the well-known Fair Labor Standards Act (FLSA), Family and Medical Leave Act (FMLA), and new healthcare reform legislation to lesser-known but equally critical rules, such as Executive Order 11246. Also included are examples of federal and state posting requirements. (Proper postings are among the first things a visiting inspector looks for—especially now that the minimum wage has been repeatedly changing.)

- Training guidelines. No matter the size of your company, expect to conduct training. Some of it is required by law; some of it just makes good business sense. Managing an HR Department of One walks you through how to train efficiently and effectively with a minimum of time and money.

- Prewritten forms, policies, and checklists. These are enormous work savers! Managing an HR Department of One has 46 such forms, from job applications and background check sheets to performance appraisals and leave requests, in both paper and PDF format.

If you’d like a more complete look at what Managing an HR Department of One covers, click the Table of Contents link below. Or, better yet, take a look at the entire program.

We’ll send it to you for 30 days’ evaluation in your own office with no obligation to buy. Click here, and we’ll be happy to make the arrangements.

Special Announcement! The new California edition is available here!